AI

Generative AI in Insurance: Transforming the Industry

VenuGopal BN

Business Development Manager

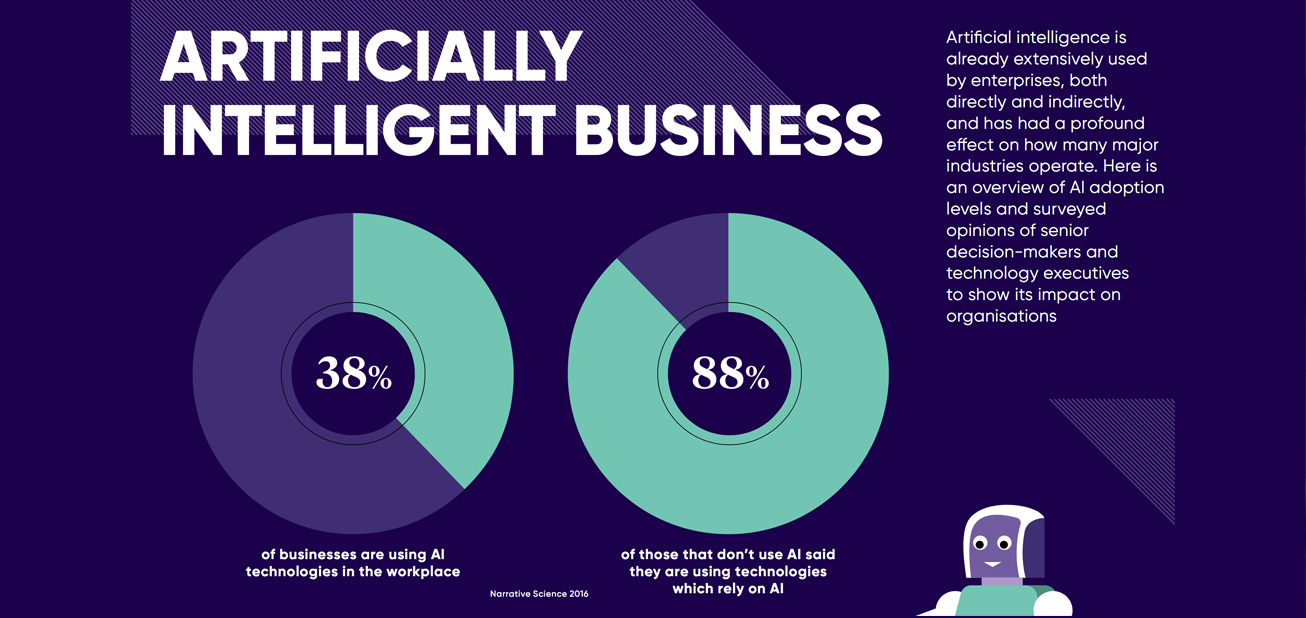

The insurance sector is undergoing a significant transformation with the integration of Generative AI. This technology is revolutionizing operations by automating processes, enhancing customer interactions, and refining risk evaluations. From handling claims to detecting fraudulent activities, AI-driven innovations are helping insurers streamline workflows and deliver better value to policyholders.

Key Applications of Generative AI in Insurance

1. Claims Processing Automation

Generative AI simplifies claims management by evaluating policy details, customer data, and claim reports to generate assessments. This reduces the reliance on manual efforts and expedites claim resolution, improving overall efficiency.

2. Fraud Detection and Risk Mitigation

By analyzing historical patterns and identifying inconsistencies, AI-powered models enhance fraud detection capabilities. This helps insurers minimize financial losses and improve claim accuracy.

3. Personalized Customer Interactions

AI-driven chatbots and virtual assistants provide round-the-clock customer support, assisting with policy information, claim tracking, and tailored insurance recommendations, ensuring a seamless user experience.

4. Advanced Underwriting and Risk Evaluation

Generative AI processes vast datasets to identify risk factors with greater precision. This enables insurers to structure competitive policies while maintaining sustainable profitability.

5. Automated Policy and Compliance Documentation

AI-driven tools generate policy documents, contracts, and compliance reports with minimal human intervention, enhancing accuracy and reducing operational workload.

Case Studies

Case Study 1: AI-Powered Insurance Claims & Policy Assistance

An AI-driven virtual assistant was deployed to guide users through claim submissions, policy details, and premium calculations, significantly improving service response times and efficiency.

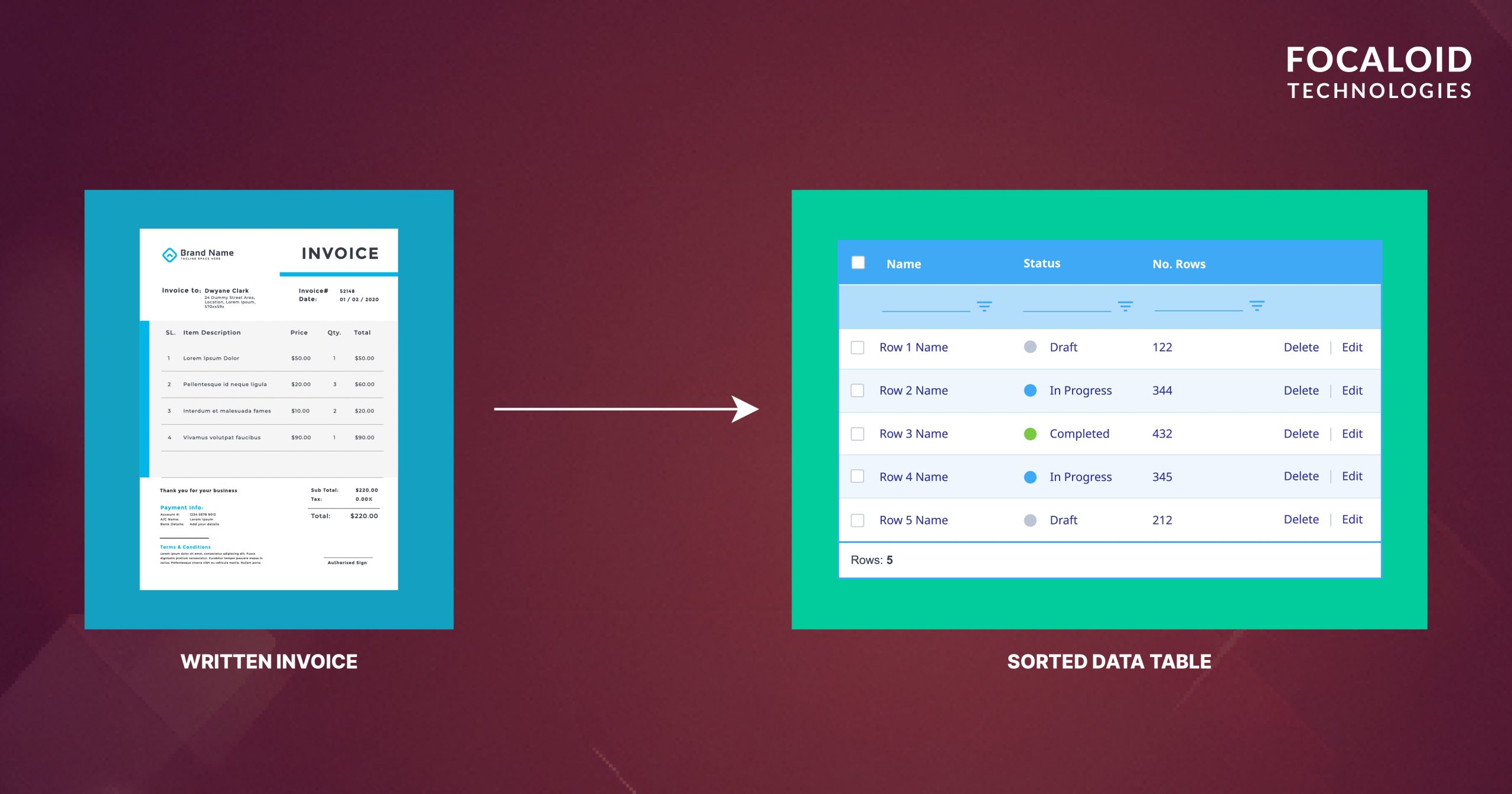

Case Study 2: AI-Enabled Claims Processing

An automated system was developed to extract claimant details, assess damage estimates, and verify policy coverage, expediting the claims settlement process.

Focaloid’s Expertise in Insurance

Focaloid Technologies delivers AI-powered solutions tailored for the insurance industry. Our capabilities include:

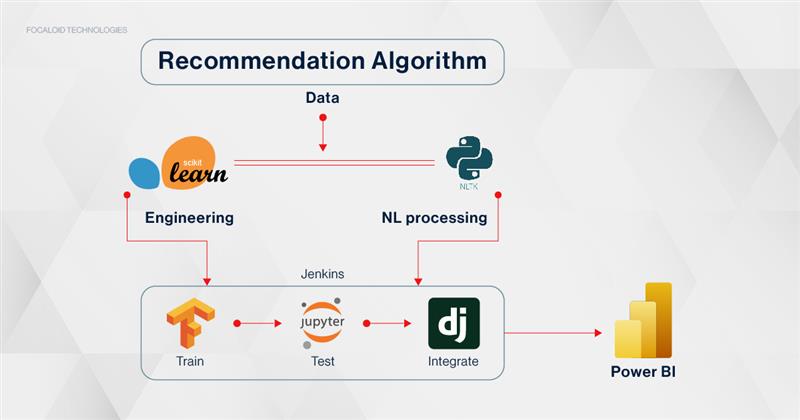

- Smart Underwriting Solutions – Utilizing predictive analytics to refine risk evaluation and pricing strategies.

- AI-Driven Claims Automation – Streamlining claims handling and reducing processing times through intelligent automation.

- Fraud Prevention Mechanisms – Deploying sophisticated AI models to detect and mitigate fraudulent claims.

- Enhanced Customer Support – Leveraging AI chatbots and virtual assistants to improve customer engagement and service delivery.

- Data Analytics and Insights – Implementing AI-based analytics to drive data-informed decision-making and optimize operations.

The Road Ahead

The role of Generative AI in insurance will continue to expand, driving automation, predictive intelligence, and personalized customer experiences. As insurers adopt AI-driven advancements, they will unlock greater operational efficiency, mitigate risks, and offer improved services to policyholders.

Conclusion

Generative AI is reshaping the insurance industry by enhancing automation, fraud detection, and customer service. By embracing AI-powered innovations, insurers can streamline processes, improve risk management, and provide customized solutions. Focaloid Technologies is at the forefront of AI adoption, empowering insurance providers to navigate this digital transformation and drive business success.

Share: